yfssabrina6929

About yfssabrina6929

Understanding Personal Loans for Extremely Bad Credit

Personal loans could be a lifeline for individuals dealing with monetary challenges, especially for those with extraordinarily unhealthy credit score. Dangerous credit can stem from numerous elements, including missed funds, defaults, or bankruptcy. This report goals to supply a complete overview of personal loans obtainable for people with extremely bad credit score, discussing their features, eligibility necessities, potential lenders, and suggestions for securing a loan.

What are Personal Loans for Extremely Bad Credit?

personal loans for extremely bad credit (personalloans-Badcredit.com) are unsecured loans designed for borrowers who’ve a credit rating beneath 580. These loans can be utilized for numerous purposes, together with debt consolidation, emergency expenses, medical payments, or home repairs. Not like secured loans, which require collateral, personal loans are based mostly totally on the borrower’s creditworthiness and skill to repay.

Options of Personal Loans for Extremely Bad Credit

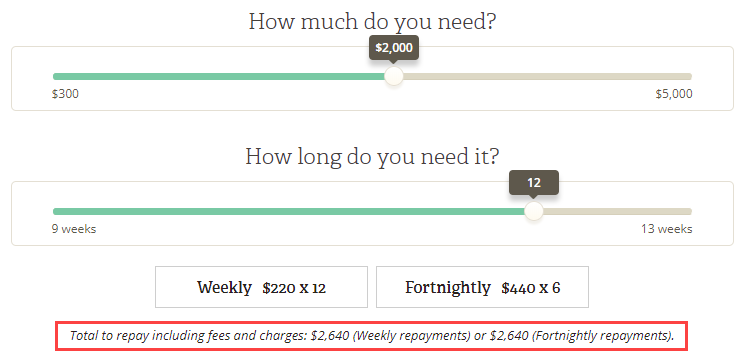

- Greater Curiosity Charges: Due to the elevated threat related to lending to borrowers with dangerous credit, interest rates on these loans are usually greater than those offered to people with good credit. Rates could vary from 10% to 36% or extra, depending on the lender and the borrower’s monetary situation.

- Shorter Loan Phrases: Personal loans for bad credit usually come with shorter repayment phrases, usually ranging from one to 5 years. Shorter phrases can result in higher monthly payments, which could also be difficult for some borrowers.

- Limited Loan Amounts: Lenders could offer smaller loan quantities to borrowers with bad credit score. Whereas some lenders might provide loans as little as $1,000, others might cap their choices at $10,000 or much less.

- Flexible Use of Funds: Borrowers can use personal loans for a wide range of purposes, permitting them to handle instant monetary wants without restrictions on how the funds are spent.

Eligibility Requirements

While eligibility criteria may vary by lender, the following are widespread necessities for obtaining a personal loan with extraordinarily dangerous credit score:

- Minimal Age: Borrowers must usually be at least 18 years old.

- Proof of Income: Lenders usually require proof of income to ensure the borrower can repay the loan. This will likely embrace pay stubs, bank statements, or tax returns.

- Identification: Borrowers must present valid identification, resembling a driver’s license or passport.

- Residency: Many lenders require borrowers to be residents of the state wherein the loan is being supplied.

- Credit score History: While bad credit may not disqualify an applicant, lenders will overview the borrower’s credit score historical past to assess their general monetary behavior.

Potential Lenders

- Online Lenders: Many online lenders specialize in personal loans for individuals with unhealthy credit score. These lenders usually have a streamlined software process, permitting borrowers to obtain approval and funding rapidly. Some in style on-line lenders include Avant, OneMain Monetary, and Upstart.

- Credit score Unions: Credit unions may supply personal loans to their members, usually with more favorable phrases than conventional banks. Borrowers may find it simpler to qualify for loans by way of credit unions, particularly if they have a protracted-standing relationship with the establishment.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper connect borrowers with particular person investors keen to fund their loans. These platforms could also be extra lenient of their credit score requirements, making them a viable possibility for those with bad credit score.

- Payday Lenders: Whereas payday loans are sometimes thought of a final resort on account of their extraordinarily excessive-curiosity rates and short repayment terms, some people with bad credit score might turn to these lenders for fast cash. However, borrowers ought to train warning and fully perceive the terms before proceeding.

Ideas for Securing a Personal Loan with Dangerous Credit

- Verify Your Credit Report: Before applying for a loan, verify your credit score report for errors or inaccuracies. Disputing any inaccuracies can enhance your credit score and improve your probabilities of loan approval.

- Consider a Co-Signer: If potential, find a co-signer with better credit score to increase your probabilities of approval and safe a lower interest charge. A co-signer agrees to take responsibility for the loan if the primary borrower defaults.

- Store Round: Completely different lenders offer various terms and interest rates, so it is essential to shop around and examine choices. Use online comparability instruments to search out the perfect deals available.

- Prepare Documentation: Collect all mandatory documentation, together with proof of income, identification, and every other required paperwork, to streamline the applying course of.

- Know Your Price range: Earlier than taking out a loan, assess your monetary state of affairs and decide how much you may afford to borrow and repay. Avoid borrowing more than vital to minimize monetary strain.

- Learn the Wonderful Print: Rigorously overview the loan terms and situations earlier than signing any agreement. Listen to curiosity charges, fees, and repayment terms to avoid any surprises.

Conclusion

Securing a personal loan with extraordinarily bad credit could be difficult, but it isn’t impossible. By understanding the features, eligibility requirements, and potential lenders, people can make informed selections when looking for monetary assistance. Whereas larger curiosity rates and shorter loan phrases may be unavoidable, proactive steps similar to checking credit studies, considering co-signers, and purchasing round may also help borrowers find the most effective loan options obtainable. In the end, accountable borrowing and well timed repayment can result in improved credit scores and higher monetary opportunities in the future.

No listing found.